georgia property tax exemption for certain charities measure

The following list sets forth the property tax exemptions that are most likely to be used by Georgia nonprofit organizations. City of Atlanta v.

Pdf Land And Property Tax A Policy Guide

Therefore the Joneses would calculate their annual property tax in the following way.

. Property Tax Exemption for Certain Charities Measure. California Property Tax Exemption for Charities. Georgia exempts a property owner from paying property tax on.

Therefore the Joneses would calculate their annual property tax in the following way. As anyone who has run a charity can tell you the IRS designation of a 501c3 non-profit doesnt necessarily apply to all of the non-IRS taxes that are. Expand an exemption for agricultural equipment and certain farm products.

Here the property tax rate is 093. The measure expanded the property tax exemption for property owned by charitable organizations to include buildings used to secure income used exclusively for the. Failed July 31 2012.

In order to qualify for one of the exemptions the property must not be used for the purpose of. 344 as signed into law provides a property tax exemption for all real property owned by a purely public charity if the charity is tax-exempt under IRC section 501c3 and the property is held exclusively for the purpose of building or repairing single-family homes to be financed to in. The referendum creates a property tax exemption for properties owned by public charities that are already exempt from federal taxes under Section 501c3 -- such as Habitat for Humanity-- if the.

Shall the act be approved which provides an exemption from ad valorem taxes for all real property owned by purely public charity if such charity is exempt from taxation under section 501 c 3 of the federal internal revenue code. In general Georgia statute grants no sales or use tax exemption to churches religious charitable civic and other nonprofit organizations. Example of Georgia Property Tax Calculation.

Georgia Dedicating Tax and Fee Revenue Amendment Shall the Constitution of Georgia be amended so as to authorize the General Assembly to dedicate revenues derived from fees or taxes to the public purpose for which such fees or taxes were intended Certain taxes and fees that consumers pay are intended to fund specific public services. 63000 x 00093 58590. The Georgia Property Tax Exemptions for Nonprofits Amendment also known as Amendment 15 was on the ballot in Georgia on November 4 1980 as a legislatively referred constitutional amendmentIt was defeatedThe measure would have provided that property owned by nonprofit organizations promoting the education and welfare of children in cities of 600000 people or.

Establishes a tax emeption for certain real property owned by charities. Is exempt from federal income tax under Section 501c2 of the Internal Revenue Code IRC. These organizations are required to pay the tax on all purchases of tangible personal property.

House Bill 344 Act no 149. Their propertys value is around 65000 which is the median for that locale. The Georgia Code grants several exemptions from property tax.

The Georgia Code grants several exemptions from property tax. An organization engaged primarily in charitable activities may be eligible for a local property tax exemption. Enacted in 1877 the exemption for property owned by a charity was not available if the property was used for any type of private or corporate income-producing activity whether the activity was chari-table or non-charitable5 After passage of the Georgia Constitution of 1945 the legislature amended the exemption statute to.

Keep in mind that this number is specific to the Jones Family. This referendum will provide an exemption from property taxes for property owned by a public charity that is already exempt from federal taxes under Section 501c3 --. Here the property tax rate is 093.

Shall the act be approved which provides an exemption from ad valorem taxes for all real property owned by a purely public charity if such charity is exempt from. What does this measure do. 7000 off recreation taxes.

2 Acquisition of the property is reasonable and proporionate to the future needs of the tax-exempt entity. Path to the ballot The measure was sponsored by Republican Repre. What types of real property have been granted an exemption from Georgias property tax.

3 2020 General Outcome. Nonprofit organizations rely on property and sales tax exemptions to provide vital services to their clients many of whom are those most in need. 4000 off school taxes.

Georgia voters in November will help decide the fate of government fees and lawsuits as well as property tax breaks for. When nonprofit organizations engage in selling tangible personal property at retail they are required to comply with provisions of the Act relating to. 65000 2000 63000.

Additionally a corporation may be eligible for a local property tax exemption if it. How did this measure get on the ballot. Ballot language and constitutional changes This measure exempts.

HB 498 - Proposition 2. 1 The property is committed to and held in good faith for an exempt use. 63000 x 00093.

Land Held for Future Charitable Use Property acquired by a tax-exempt entity and held for future needs may qualify for exemption if. The Georgia Charitable Institutions Tax Exemptions Referendum also known as Referendum C was on the November 7 2006 ballot in Georgia as a legislatively referred state statute where it was approvedThe measure expanded the property tax exemption for property owned by charitable organizations to include buildings used to secure income used exclusively for the. However due to a 2009 Court decision regarding GCN member Nuçis Space in Athens Georgia changes to the definition of organizations of purely public charity could have had drastic effects on many.

The Jones Family lives in Chattahoochee County. Georgia Ballot Measure - Referendum A. Transportation - Special-Purpose Local-Option Sales Tax - Georgia Mountains District.

Sept 28 2020. Property Tax Exemption for Certain Charities Measure. 65000 2000 63000.

Their propertys value is around 65000 which is the median for that locale.

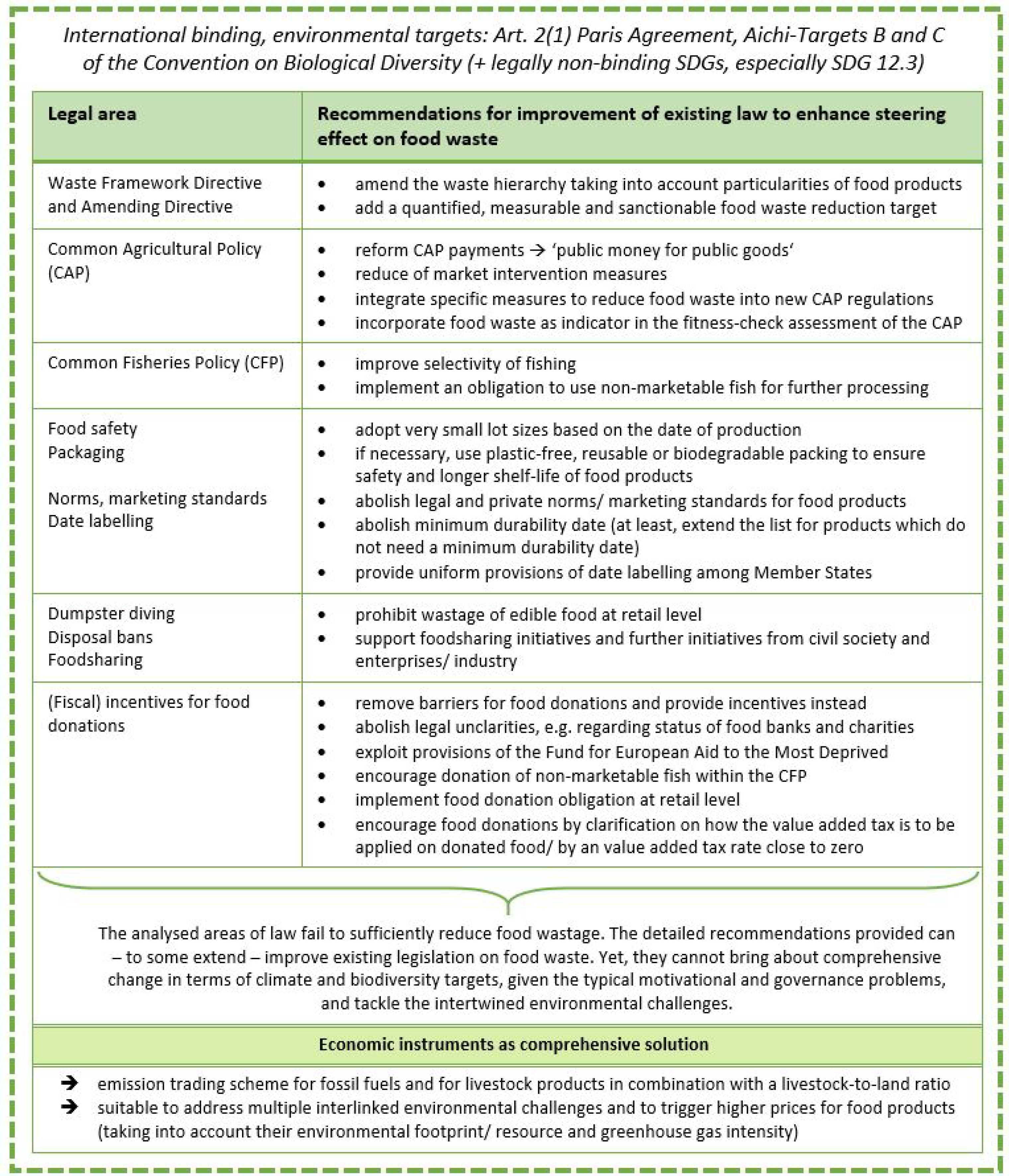

Land Free Full Text Challenges Of Food Waste Governance An Assessment Of European Legislation On Food Waste And Recommendations For Improvement By Economic Instruments Html

3 11 3 Individual Income Tax Returns Internal Revenue Service

501 C 3 Vs 501 C 4 Key Differences And Insights For Nonprofits

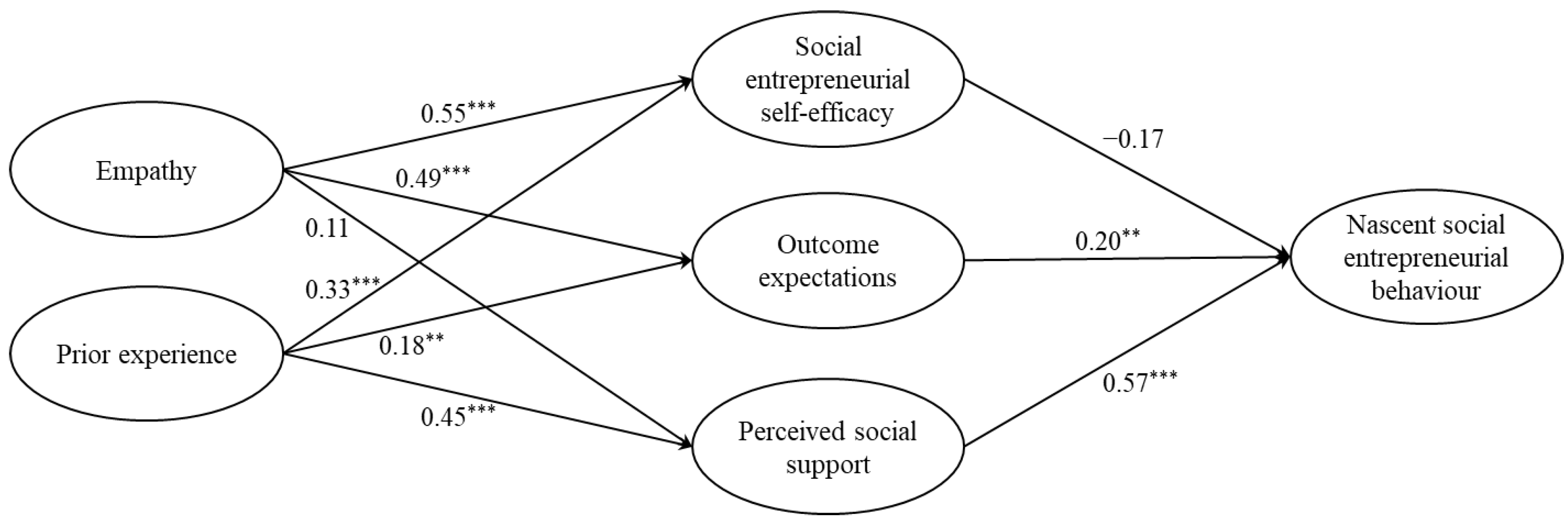

Ijerph Free Full Text Exploring The Determinants Of Nascent Social Entrepreneurial Behaviour Html

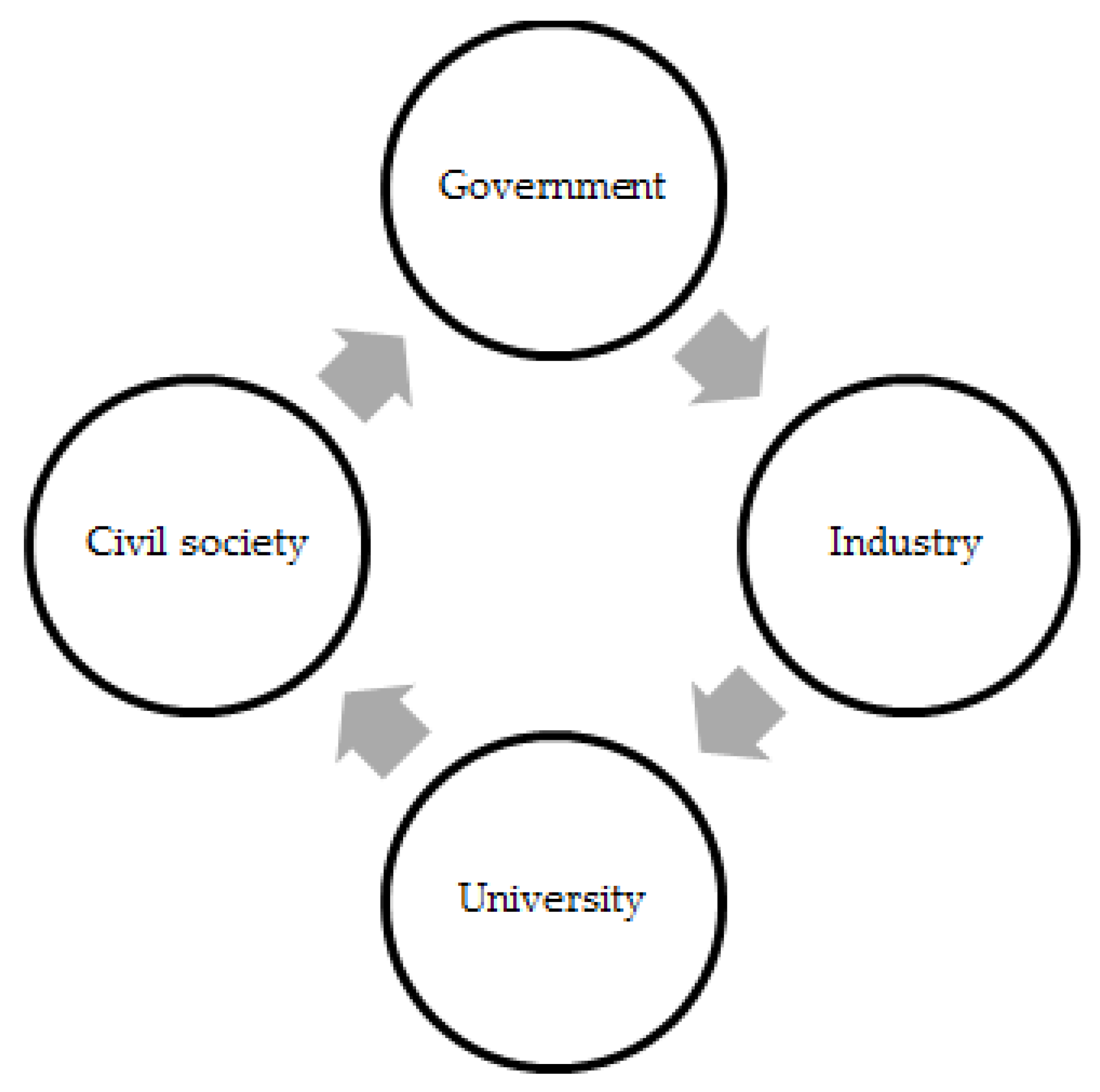

Sustainability Free Full Text Digital Entrepreneurship Services Evolution Analysis Of Quadruple And Quintuple Helix Innovation Models For Open Data Ecosystems Html

Draft Compilation Guide On Financial Soundness Indicators In Policy Papers Volume 2003 Issue 008 2003

Draft Compilation Guide On Financial Soundness Indicators In Policy Papers Volume 2003 Issue 008 2003

Charitable Trusts And Cy Pres Doctrine Overview The National Law Review

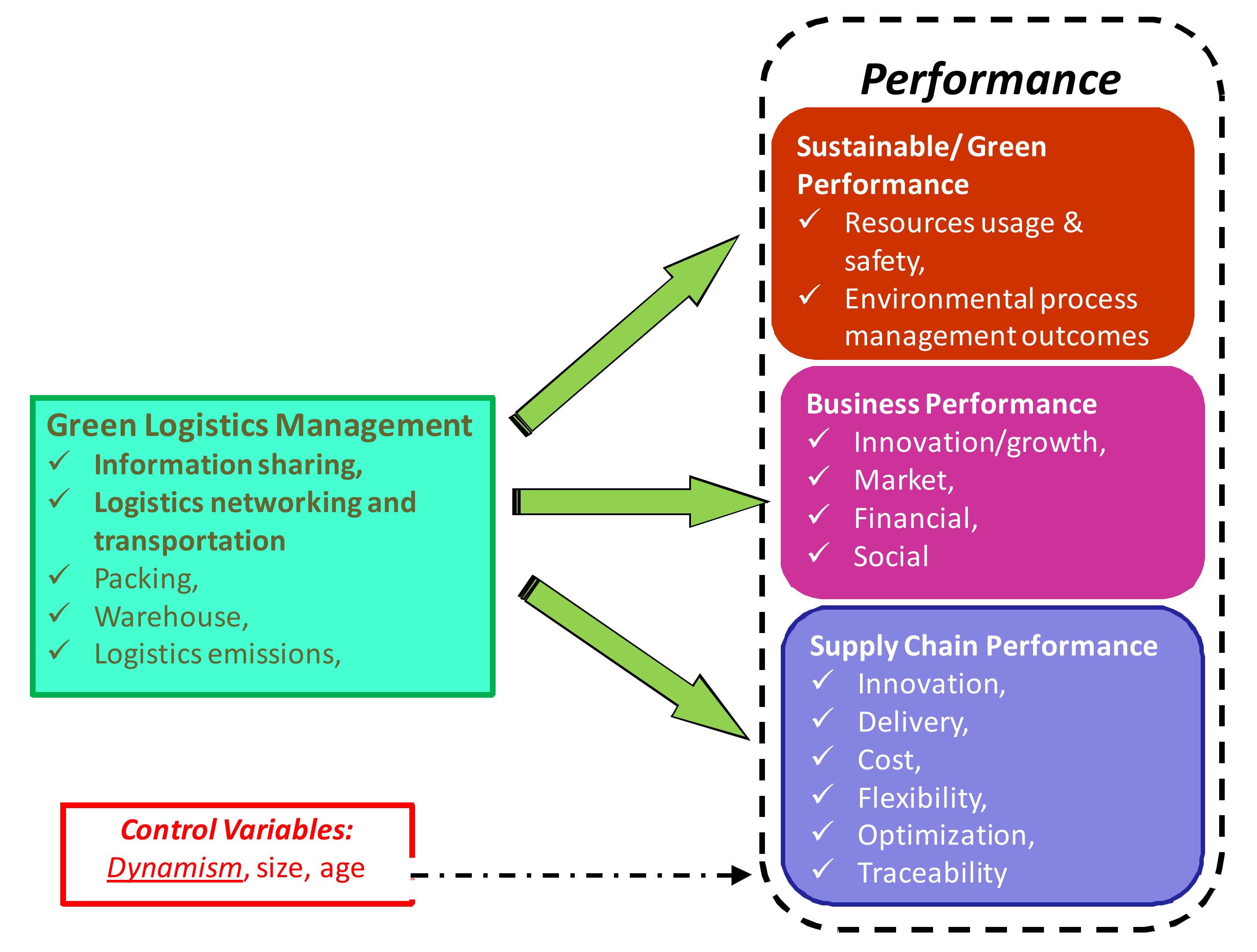

Sustainability Free Full Text Implications Of Green Logistics Management On Sustainable Business And Supply Chain Performance Evidence From A Survey In The Greek Agri Food Sector Html

3 11 3 Individual Income Tax Returns Internal Revenue Service

Sustainability Free Full Text Digital Entrepreneurship Services Evolution Analysis Of Quadruple And Quintuple Helix Innovation Models For Open Data Ecosystems Html